HOMEOWNERSHIP, MORTGAGE DEBT AND TYPES OF MORTGAGE AMONG CANADIAN FAMILIES, 1999 - 2016

HOMEOWNERSHIP, MORTGAGE DEBT

AND TYPES OF MORTGAGE

AMONG CANADIAN FAMILIES,

1999 - 2016

Released at 8:30 a.m. Eastern time in The Daily, Thursday, August 8, 2019 Despite a slight decline from 2012 to 2016, Canadian families are more likely to own a home than they were two

decades ago. However, the proportion of those who have paid off their mortgage has declined from 46%

in 1999 to 43% in 2016, meaning more Canadian homeowners have a mortgage. This latter trend is consistent

across all age groups.

Despite a slight decline from 2012 to 2016, Canadian families are more likely to own a home than they were two

decades ago. However, the proportion of those who have paid off their mortgage has declined from 46%

in 1999 to 43% in 2016, meaning more Canadian homeowners have a mortgage. This latter trend is consistent

across all age groups.While rising housing prices have increased the wealth of many Canadian homeowners, Canadians also saw their mortgage debt increase. From 1999 to 2016, the median mortgage debt almost doubled in real terms for Canadian families, rising from $91,900 to $180,000.

These results are from the new study, "Homeownership, mortgage debt and types of mortgage among Canadianfamilies," published today in Insights on Canadian Society.

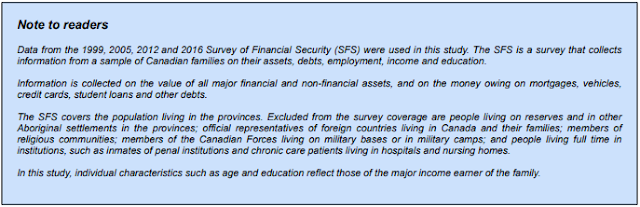

The study uses data from the Survey of Financial Security to examine trends in homeownership, mortgage debt, and types of mortgage rates selected by Canadian homeowners (fixed, variable or a combination of both).

The new infographic "What do we know about homeownership and mortgage debt in Canada?" is also available.

Fewer homeowners have paid off their mortgage

In 2016, 43% of Canadian families who owned their house had paid off their mortgage. This is down from 1999, when 46% of homeowners had paid off their mortgage.The proportion of families who had paid off their mortgage declined in all age groups, particularly among those whose major income earner was aged 35 to 54.

Without population aging, however, the overall decline would have been even larger. Relatively older families are more likely to have paid off their mortgage, and older cohorts now make up a larger proportion of the population. Specifically, without population aging, the proportion of families who had paid off their mortgage would have declined from 46% in 1999 to 36% in 2016.

A widespread increase in mortgage debt, sustained by rising housing prices and low interest rates, is likely the reason behind the decline in the proportion of families who have paid off their mortgage.

Mortgage debt nearly doubled from 1999 to 2016

The median mortgage debt of Canadian families with a mortgage almost doubled from 1999 to 2016, rising from $91,900 to $180,000 in 2016 constant dollars. The increase was spread across most regions of Canada, however, it was more prominent in large urban areas.The amount of mortgage debt increased in nearly every demographic group, and was particularly evident among middle-aged individuals and couples with children. In the latter group, median mortgage debt increased by 112% over the period studied, from $96,800 to $205,000.

From 1999 to 2016, mortgage debt accounted for 84% of the increase in the total debt of Canadian families. Consumer debt, which includes debt on credit cards, lines of credit, unpaid accounts and all other forms of debt, accounted for the remaining 16%.

Most Canadian families with a mortgage have a fixed rate

Given the increased relative importance of mortgage debt among Canadian families, it is also important to examine how Canadians finance this debt.The majority of homeowners with a mortgage have a fixed mortgage rate. In 2016, 74% had a fixed mortgage rate, while 21% had a variable rate and 5% had a combination of both. Recent data published by Mortgage Professionals of Canada show that, in 2018, the proportions were 68%, 27% and 5%, respectively.

These results varied across family characteristics. In general, families with a longer amortization period were more likely to have a fixed rate than those with shorter amortization periods, possibly because people with longer amortization periods may want to opt for more stability.

In addition, families who maintained a household budget were more likely to have a fixed rate, possibly reflecting the fact that those who budget prefer the certainty of fixed payments over time.

Definitions, data sources and methods: survey number 2620.

The study "Homeownership, mortgage debt and types of mortgage among Canadian families" is now available in Insights on Canadian Society (Catalogue number 75-006-X).

The infographic "What do we know about homeownership and mortgage debt in Canada?" is also available.

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Sharanjit Uppal (613-854-3482; sharanjit.uppal@canada.ca).

For more information on Insights on Canadian Society, contact Sébastien LaRochelle-Côté (613-951-0803; sebastien.larochelle-cote@canada.ca).